Warning: This article is going to sound contradictory…

For two reasons:

- Different time frames

- A POTENTIAL change in cycle dynamics

Anyone who has been reading and following me since 2016 or more specifically since December 2023 when I correctly predicted the temporary top and sell-off after February 6, 2024, and the beginning of the move into the rocket zone after October 8, 2024, knows I’m super bullish Bitcoin and bullish gold.

And that I believe $150,000 Bitcoin by mid 2025 is a high probability and $3,500 Gold is as well.

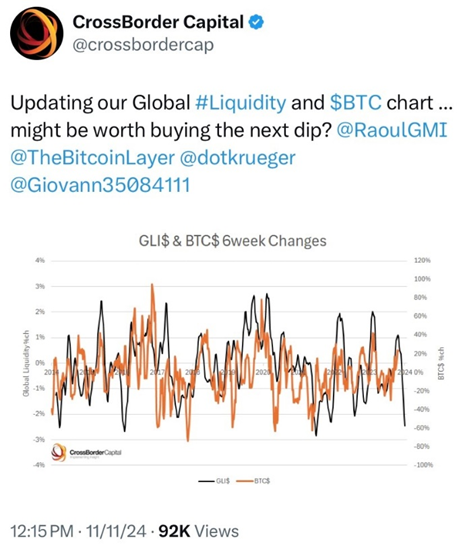

An increase in global liquidity due to lower interest rates and a weaker dollar are the main drivers for this.

I strongly believe global liquidity is going to increase. Why?

Simply, it has to. The details are not the purpose of this article but to summarize:

Ever since 2008, governments around the world cut interest rates to zero and have started to monetize the interest payments every four years.

Governments have no intention (or really any ability) to cut deficits. And debt has become unsustainable. This is why Long Term, the dollar will depreciate significantly (monetary debasement) against gold and Bitcoin.

This will ultimately lead to inflation.

But because they need to monetize the interest, every four years they have to cut interest rates (weaken the dollar) in order to roll the interest into the debt.

Lyn Alden has a saying “nothing stops this train” to describe the continued government deficits. No matter how much you like Trump and Elon/Vivek’s D.O.G.E.; deficits will continue.

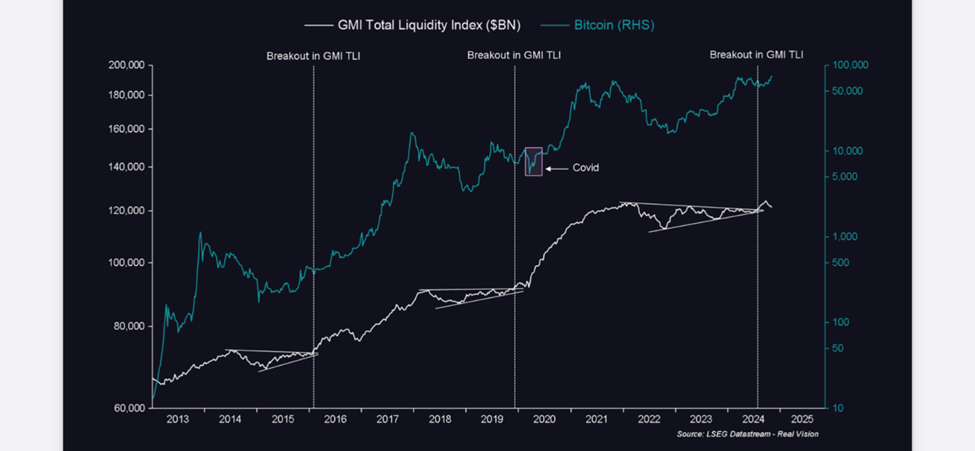

And as shown by Julien Bittel and Raoul Pal from Real Vision, global liquidity has broken out of its consolidation pattern. Which means it’s going higher.

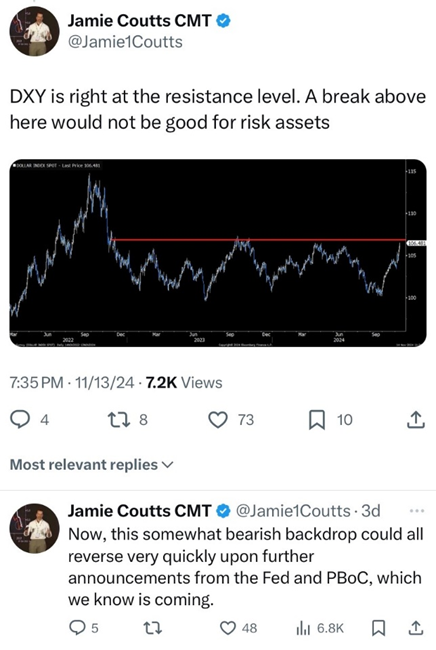

But in the very short term, the dollar has been strengthening, and global liquidity has turned down.

And sometime in 2025 (my guess is mid-2025), inflation will creep back up. This will be after cutting rates, wreaking the dollar, and rolling interest payments into the debt at lower rates.

Once inflation starts creeping back up, the Fed will be forced to tighten, increase rates, the dollar will rise, and liquidity will dry up.

This cycle will continue until it doesn’t…

When the cycle ends is when I believe the dollar will eat itself. Which means it will go so high that it will ultimately fail and faith in it as the global currency will be lost.

Read my book, Protect your Money and Prosper, from 2016 for more details. In that book I wrote that this may happen by 2023. But bubbles can last longer than most can imagine. And I didn’t have a full grasp of TIME back then.

I now think this occurs sometime after 2029. Probably between 2029-2033.

This is why timeframes matter and contradictions can be explained by understanding time.

If the dollar continues higher (reducing liquidity) over the next 1-3 months, risk assets (including Bitcoin) COULD sell off…

But this is just a temporary air pocket.

This would actually give more credence (I.e cover) for the Fed to accelerate easing.

And lead to liquidity increasing massively over the medium term (3-9 months out).

This will cause inflation to increase and the liquidity “drug” to be taken away, causing a bear market over the intermediate term (9-18 months out).

Then the cycle will repeat…

Until the long term (2029-2033??) when control is lost and the suppression of recessions can’t continue. And we won’t get a recession, we’ll get a depression.

So when I say Bitcoin is going to soar now that we’re in the rocket zone, remember I told you this begins after October 8,2024 and ends sometime in 2025 (most likely December).

But that doesn’t mean we won’t have drops in the real short term due to the liquidity dynamics noted above or even the medium term when inflation ticks higher.

Short term, my view is to do nothing…

Because Bitcoin MAY NOT sell off significantly which I’ll discuss shortly.

And over the medium term when inflation moves higher, I’ll exit all non-Bitcoin cryptos and POTENTIALLY take profits on Bitcoin. Because the liquidity drug will get taken away.

But over the long term, I want all my wealth stored in Bitcoin and Gold because the dollar will be debased and when it eats itself, hard assets are the only thing to own.

And you know from my book, referred to earlier, and my more recent book, The Bitcoin Blueprint, why gold and Bitcoin are the key to surviving the (in my opinion) inevitable depression as the 100-year cycle rears its ugly head.

Hopefully this clarifies why timeframes matter and what I’m saying in terms of Price moving through Time is not contradictory.

Now for my next “contradiction”:

The cycle could be changing…

I’ve said many times, I try hard to avoid thinking “this time is different.”

But it’s hard not to mention how it could be. And I’m not really saying it will be different. The cycle will continue.

What might be different is that the upside over the medium term could result in much higher prices than even I can imagine.

And the downside may not see the normal 80% drops as the liquidity is pulled. There will still be sell-offs…

BUT they may not be as drastic as other cycles.

Why?

Numerous reasons.

Institutions are now entering Bitcoin. The ETF approvals back in January 2024 were the start of this. Blackrock’s CEO Larry Fink has come out suggesting Bitcoin is a key part of portfolios.

Then there’s the incoming crypto friendly administration.

Senator Lummis of Wyoming has always been crypto friendly. The Republicans now control the Senate, House and White House.

She’s immediately proposing a bill for the government to buy 1 million Bitcoin over 5 years as part of a strategic reserve.

The SEC chair Gary Gensler is on his way out. He has been anti crypto and created significant opaqueness around crypto investing. That will most likely change as Trump has changed his view on crypto and wants the US to lead in crypto innovation.

And we don’t yet know who Trump will appoint as Treasury Secretary. But one of the leading candidates, who Elon Musk and RFK Jr. is supporting, is very pro Bitcoin.

Even if Lutnick is not the Treasury Secretary he will most likely have influence due to his consistent support of Trump.

And I know he’s only the Health Secretary nominee but RFK Jr. is pro Bitcoin. He will have continued influence.

If the US is buying Bitcoin as part of a strategic reserve, so will other countries. They’ll have to. And as regulation clarifies, institutions will come into crypto more heavily.

All of these parties have SIGNIFICANTLY more capital than the historical participants in Bitcoin and crypto overall.

And these parties will not be as unstable as historical parties in Bitcoin. Meaning they will not be as quick to sell.

Their buying pressure will increase the overall market cap (potentially much higher than I anticipated). This will make the market much more “mature” (read The Bitcoin Blueprint).

When liquidity is drained as inflation comes back and these big money parties don’t sell (or consistently buy if Senator Lummis’s bill is passed), price will not fall off a cliff like in past cycles.

What does all of this mean?

You should already be allocated to Bitcoin. If not, we MAY (and I certainly hope) get one last short term opportunity to buy at lower prices (most likely still above $70k-$75k).

And when we reach the top of the rocket zone in 2025, don’t be “cute” and think you can sell and buy back at an 80% lower price.

What I’ll most likely do and shared with some of my friends is the following:

I’ll sell ALL of my non-Bitcoin crypto. And I’ll take lifestyle chips off the table out of profits. What do I mean by lifestyle chips?

I told my friend who is looking to buy a beach lot to develop, to determine how much he needs. Invest to where a 100% increase or more in price will significantly provide him the ability to pursue that goal.

Once we see the rate of change in inflation trend higher, start to take those profits and stay invested with his original capital.

IF we get do get a big selloff because some of the things above don’t come to reality, take some of those profits and buy back towards the bottom.

IF not or even if so (because he’ll make more during the next cycle through reinvesting), wait until the real estate cycle turns (my guess is a bottom sometime around 2030ish which aligns my depression timeframe) and then pursue his dream.

I’ll be following the same playbook. I just have different objectives.

Do not get confused. Read everything I’ve written that is linked throughout this post. Learn to hold multiple contradictory concepts in your head at the same time through understanding timeframes.

And utilize this knowledge and conviction through real education (not mainstream nonsense) to prepare yourself and your family for protection through what I believe will be a devastating period in the future.

Because if you do…

The other side will be glorious!

*Not financial advice. Educational purposes only.

Want more insights like this? Subscribe to the CPA Gone Mad Newsletter for free updates.