You won’t believe me if I’m generic about what’s going to happen.

I know from experience.

How many of you bought Bitcoin in 2019 when it was below $10,000 and I said this is the best no risk opportunity of my life?

What did I say? I said if you buy Bitcoin below $10,000, it’s absolutely going back above its previous all-time high during the next cycle.

And when it does get above $20,000, you can sell half, take your initial capital off the table and let the rest ride.

If you did this, you not only would have taken your initial capital off the table, you would’ve seen Bitcoin rise to over $66,000.

Would you have sold at the exact top?

Most likely not. I didn’t.

I sold most of my Bitcoin around the $45-$50k level. Why?

I didn’t have a complete grasp of TIME.

I understood PRICE but not TIME. So I spent my free time over the last 4 years trying to better understand time.

Do I have it all figured out? Absolutely not.

But for Bitcoin?

Follow along and you’ll see for yourself.

That’s why I’m being specific. I’m going to tell you the exact dates.

I already have all the dates laid out.

After Thanksgiving dinner, I took my family through the whole plan so they can understand and prepare.

Now I’ll walk you through piecemeal.

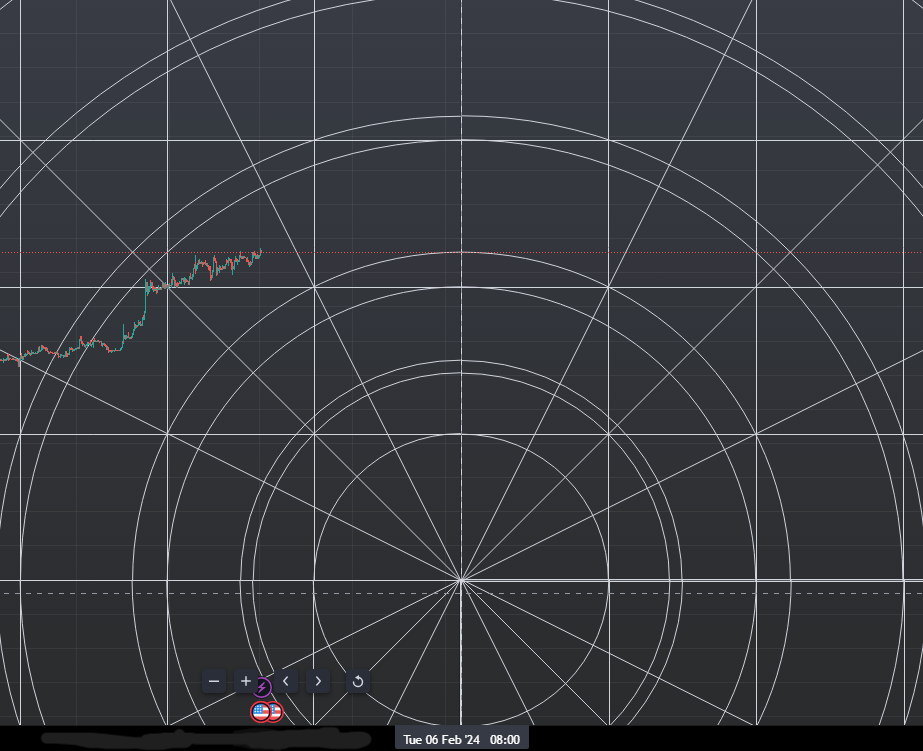

Which brings me back to February 6, 2024.

Why is this date important?

It’s the first date of the next cycle which should mark a temporary top in Bitcoin.

Will it happen that exact day? Probably not.

But into and after 2/6/2024 we are going to look for a temporary top and bottom within 1-2 months from that temporary top.

If that bottom after the temporary top stays above the low of $16,250 recorded on 11/22/22, the new bull market in Bitcoin is confirmed.

Will Bitcoin take off from there?

Probably not. It’ll most likely trade sideways or slightly higher for the next 6-8 months until our next key date.

Why?

Because that’s what markets do. They frustrate and shake out the 99% of people who think cycles are nonsense and refuse to learn about WHY Bitcoin is going to behave the way it will.

That’s the opportunity. If markets didn’t behave in these patterns there would be no opportunity.

So watch for that date.

If we get a sell-off, I’m buying huge because it will be the last big buying opportunity of this cycle.

But that doesn’t mean you can’t continue to buy until our next date.

Remember, if something is ultimately going north of $200,000, it’s not that big of deal if you buy it at $25k vs. $45k, you’re still going to have outsized returns compared to everyone else.

Why will there be a top around 2/6/24?

Because it’s math and how price moves across time.

You’ll turn on CNBC and they will provide a narrative that says it’s the reason….

But you’ll know that’s nonsense. You’ll know that we knew it was going to happen just because of how price moves through time.

The “event” that they say caused the price movement is just how people that don’t understand the mathematics built into the universe must try to explain things.

So I’m going to guess at the headlines.

Bitcoin ETF approval is a big sell the news event!

Inflation killed the consumer during the Q4 shopping season and earnings releases are terrible as companies adjust expectations down for anticipated continued weakness.

Another bank fails as depositors fed up with 0% interest on checking accounts woke up to the 5% interest they can get from a quick transfer to the US Treasury.

Commercial real estate problem, credit crunch, etc.

The point, it’s not the “event” that will “cause” the price to move.

It is the timing that will cause the price to move and the “event” is just a narrative to explain the price movement.

The next date…

This is the date you need to be in Bitcoin by…

*Educational purposes only, not financial advice.

Want more insights like this? Subscribe to the CPA Gone Mad Newsletter for free updates.